The Buzz on Small Business Accountant Vancouver

Wiki Article

About Tax Consultant Vancouver

Table of ContentsFacts About Virtual Cfo In Vancouver UncoveredThe Definitive Guide to Virtual Cfo In VancouverVancouver Tax Accounting Company Can Be Fun For AnyoneSmall Business Accountant Vancouver Things To Know Before You Get This

Due to the fact that it's their job to remain up to date with tax obligation codes and also laws, they'll be able to suggest you on just how much cash your business requires to deposit so there aren't any surprises. Prior to you go crazy an audit isn't always bad! The dreaded "IRS audit" occurs when a business isn't filing their taxes correctly.

When it pertains to planning for any kind of audit, your accounting professional can be your buddy since they'll conserve you loads of time planning for the audit. To prevent your company from getting "the poor audit", below are some pointers to comply with: Submit and pay your tax obligations promptly Do not incorrectly (or neglect to) data company sales and invoices Don't report individual expenses as overhead Keep exact organization documents Know your particular company tax obligation reporting responsibilities Recommended reading: The 8 The Majority Of Common Tax Obligation Audit Sets Off Quick, Books After assessing the fundamental audit as well as accounting services, you're probably wondering whether it's something you can manage on your own or require to hand off to a specialist.

Will you require to prepare weekly or regular monthly economic records or just quarterly as well as annual reports? An additional indicate think about is monetary expertise. Exists a person in your workplace that is qualified to manage vital bookkeeping and also bookkeeping solutions? Otherwise, an accountant could be your most safe wager.

Accounting professionals are fairly versatile as well as can be paid hourly. On top of that, if you do choose to contract out audit and bookkeeping services, you would not be in charge of offering advantages like you would for an in-house staff member. If you determine to hire an accountant or accountant, right here are a couple of suggestions on finding the appropriate one: Check referrals as well as previous experience Ensure the prospect is enlightened in audit software program and also innovation Ensure the candidate is fluent in accounting plans and treatments Test that the prospect can clearly interact monetary language in words you recognize See to it the candidate is sociable and also not a robot Small company proprietors and also entrepreneurs usually outsource audit as well as accounting services.

Some Known Incorrect Statements About Tax Accountant In Vancouver, Bc

We compare the most effective right here: Swing vs. Zoho vs. Quick, Books Don't neglect to download our Financial Terms Cheat Sheet, that includes crucial bookkeeping and bookkeeping terms.

Inevitably, you will supply us with accurate measurable details on economic setting, find here liquidity and cash flows of our organization, while guaranteeing we're compliant with all tax obligation regulations. Handle all accountancy purchases Prepare spending plan forecasts Release economic declarations in time Take care of monthly, quarterly as well as annual closings Reconcile accounts payable and receivable Ensure prompt bank payments Calculate taxes as well as prepare tax obligation returns Manage balance sheets as well as profit/loss declarations Report on the business's monetary health as well as liquidity Audit financial transactions and also papers Reinforce monetary data discretion and also conduct data source backups when necessary Comply with economic plans and also policies Function experience as an Accounting professional Excellent expertise of bookkeeping regulations and treatments, including the Usually Accepted Audit Principles (GAAP) Hands-on experience with accountancy tax accounting firms software program like Fresh, Books and also Quick, Books Advanced MS Excel abilities including Vlookups and also pivot tables Experience with general journal features Strong attention to detail and also excellent logical skills BSc in Accounting, Finance or pertinent degree Extra certification (Certified public accountant or CMA) is a plus What does an Accounting professional do?

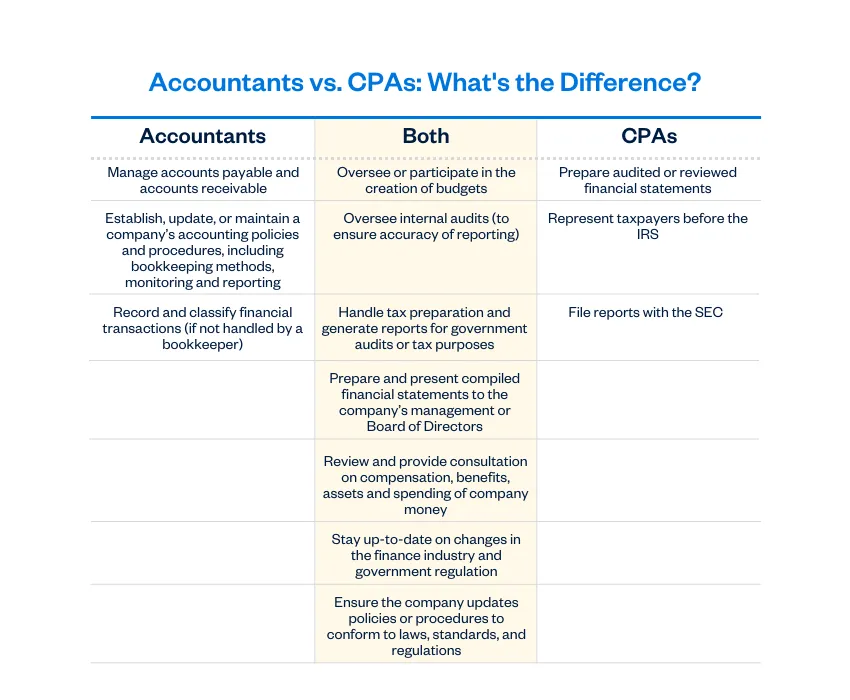

What are the duties as well as duties of an Accountant? The obligations of an Accounting professional can be rather extensive, from auditing economic files and also performing monetary audits to integrating financial institution statements and also calculating taxes when submitting annual returns. What makes a great Accounting professional? A good accountant is not simply a person with money skills but likewise a specialist in human relations and communication.

That does Accountant collaborate with? Accounting professionals function with magnate in small firms or with supervisors in big companies to make sure the top quality of their monetary records. Accounting professionals may additionally team up with private team leaders to obtain as well as investigate economic documents throughout the year.

Getting The Outsourced Cfo Services To Work

The term bookkeeping is really typical, specifically during tax obligation period. Look At This Before we dive right into the significance of accounting in organization, allow's cover the fundamentals what is bookkeeping? Audit refers to the organized as well as thorough recording of monetary deals of an organization. There are several kinds, from representing small businesses, government, forensic, and also administration bookkeeping, to representing companies.

Legislations and guidelines vary from one state to another, but proper accounting systems as well as processes will aid you make certain statutory compliance when it involves your service (outsourced CFO services). The accountancy function will certainly guarantee that responsibilities such as sales tax obligation, BARREL, income tax obligation, as well as pension plan funds, among others, are properly dealt with.

Business fads and also forecasts are based on historical financial information to keep your operations rewarding. This financial information is most proper when given by well-structured bookkeeping processes. Organizations are needed to file their financial statements with the Registrar of Business. Noted entities are required to submit them with supply exchanges, along with for straight and indirect tax obligation filing functions.

Little Known Facts About Outsourced Cfo Services.

Report this wiki page